A blog by Salamat Ali, Neil Balchin, Victor Kitange and Brendan Vickers from the Commonwealth Secretariat's International Trade Policy Unit

The SAMOA Pathway, the current overarching UN framework addressing the unique challenges faced by Small Island Developing States (SIDS) and supporting their development, concludes in 2024. SIDS and their development partners will meet at the SIDS4 conference in Antigua and Barbuda from 27-30 May to reset priorities and develop a new programme of action to accelerate their sustainable development.

In this blog we examine the implications of SIDS’ underlying vulnerabilities for trade and investment and outline policy actions for addressing these challenges.

Three binding structural constraints compromise resilience and hamper trade and investment flows to SIDS

- The constraints of size: SIDS are home to just 0.8% of the world’s population (65 million of 8 billion) on more than 1000 islands. They also have very small physical land mass (3% of the Earth’s land area, that restrict economies of scale and scope, resulting in concentrated production bases and limited export baskets. On average, SIDS export around half the number of products (1,315) compared with developing countries overall (2,888).

- Geographic isolation: The remoteness of many SIDS from major markets as well as from key shipping routes results in higher trade costs, at about 25% on average. This severely affects the flow of trade to and from these countries, increasing the threat of food and energy insecurity. It also makes them extremely vulnerable to ongoing global economic fragmentation, which threatens to reduce their trade with major partners and raise the prices of essential goods.

- Vulnerability to climate change and natural disasters: This is an existential threat for SIDS as they experience some of the most severe impacts of floods and storms. Climatic changes and increasingly frequent natural disasters affect economic activities in climate-sensitive sectors such as agriculture, fisheries and tourism-related services, which are the lifeblood of many SIDS’ economies.

These inherent structural challenges interact with each other in complex ways: for instance, their small size constrains their capability to adapt to climate change and remoteness affects recovery and relief efforts. These constraints create food and energy insecurity, and adversely affect trade and investment flows.

Implications for international trade

With their small and highly open economies, SIDS rely heavily on international trade. The average trade-to-GDP ratio (a measure of reliance on international markets) for SIDS is 95% compared with 63% globally. This outward orientation, combined with their small size, makes SIDS extremely vulnerable to external shocks. They are especially vulnerable to trade-related shocks affecting their food and energy security:

- SIDS import 72% of key food products, a notably higher share than other developing nations (54%), rendering them susceptible to global food price fluctuations.

- Their reliance on imported fossil fuels for energy means SIDS face some of the highest electricity costs in the world and are acutely vulnerable to fluctuations in energy prices and supplies in global markets.

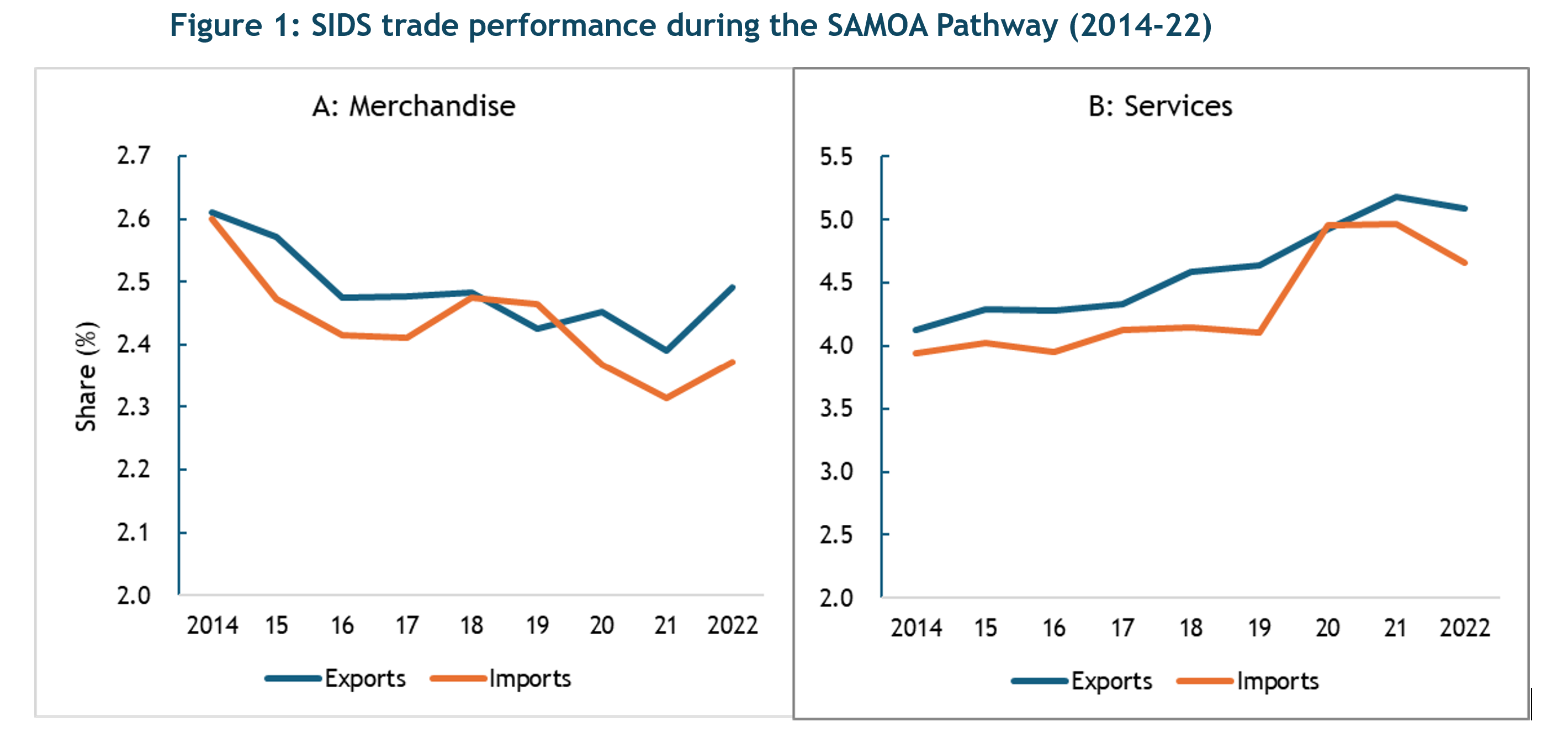

Despite their openness to international trade, the overall trade performance of SIDS during the SAMOA Pathway has been mixed. The combined value of their exports increased from US$490 billion in 2014 to $620 billion in 2022, while their imports grew from $490 billion to $604 billion. Despite rising in absolute terms, their share of global merchandise trade declined marginally in the case of both exports and imports (Figure 1).

In contrast, the services sector has performed relatively better. The value of services exported by SIDS increased from US$217 billion to $362 billion in this period, while imports climbed from $205 to $307 billion, raising the share of services in SIDS’ overall exports and imports by almost one percentage point each.

Implications for investment flows

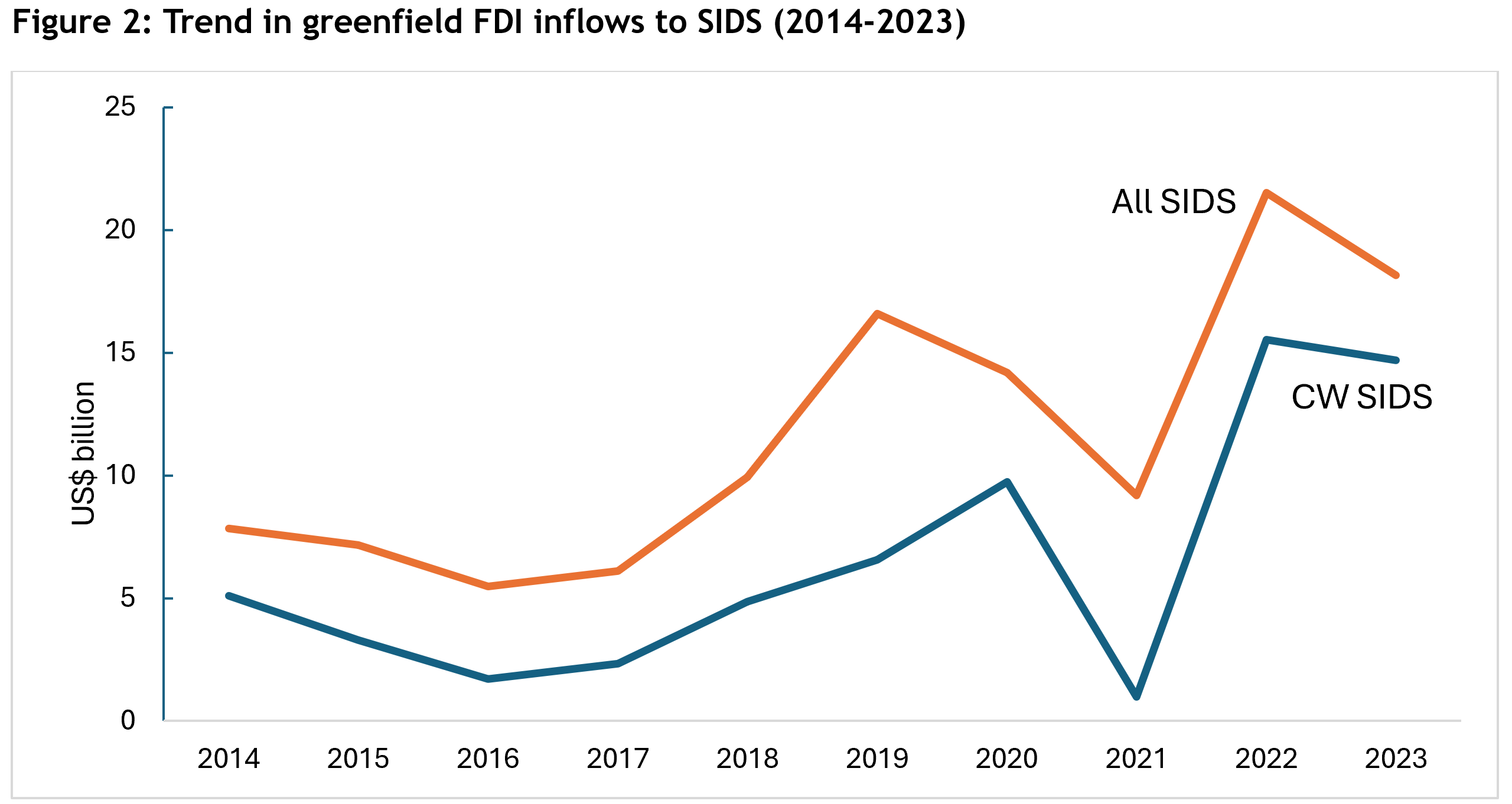

The structural constraints faced by SIDS contribute to high levels of volatility in inflows of greenfield foreign direct investment (FDI) as they are perceived by investors to be high-risk markets (Figure 2). Consequently, the combined value of greenfield FDI projects announced in these economies has fluctuated significantly since 2014 at the start of the SAMOA Pathway and remains limited as a share of global greenfield investment.

The volatility in greenfield investment was especially evident during the COVID-19 pandemic, when the value of investments announced in SIDS fell from US$16.6 billion before the pandemic in 2019 to $9.2 billion in 2021. Greenfield FDI inflows to these countries have since rebounded, reaching a combined $21.5 billion in 2022 and $18.2 billion in 2023, mainly because of very large investments announced in the oil and gas sector in Guyana.

Source: Authors (calculated using fDi Markets data from the Financial Times Ltd., May 2024)

Three key priorities for building resilience in the next programme of action

The SIDS4 conference presents an opportunity to renew international support for building resilience in SIDS. Action in the following areas would help to address underlying vulnerabilities and accelerate progress towards sustainable development.

- Diversifying investment and targeting transformative sectors. FDI in SIDS is concentrated in a few host countries, originates from a small number of source countries, and targets limited activities and sectors. Diversifying away from traditional tourism-related services to modern, skill-intensive and technology driven digital services can overcome the barriers of remoteness, but will require significant upscaling of investments in digitalisation as well as improved human and technological capabilities in SIDS. Similarly, greater investment in renewable energy can reduce the cost of electricity and transportation and enhance sustainability.

- Harnessing the potential of the blue economy. SIDS control, on average, an ocean area 28 times the size of their land mass, or 16.1 per cent of the world’s total exclusive economic zones. When considered from this point of view, they are “big ocean states” rather than small island states; and can utilise the economic potential afforded by their vast oceans and the blue economy to overcome constraints related to their small size.

- Improving support to address climate change and mitigate its impacts. Addressing climate change requires much more concerted effort by multilateral institutions. Operationalisation of the loss and damage fund established at COP27 would provide some insurance for SIDS against climate disasters. Similarly, the concessional financing under the IDA and other concessional funds from the development banks, needs to be delinked from income per capita alone and broadened to include vulnerability indices such as the Multi-Dimensional Vulnerability Index (MVI) which complements the Commonwealth’s Universal Vulnerability Index. The climate threat can also be converted into a development opportunity for SIDS by prioritising green agricultural products and sustainable fisheries practices and ensuring they benefit from greater access to foreign markets.