By Dr Mohamed Z M Aazim, Adviser, Debt Management, Commonwealth Secretariat

Government debt is increasing in most Commonwealth countries. In some cases, it is growing faster than the economies that need to support it.

This year, general government debt (GGD) – which includes borrowing by central government and state-owned enterprises – has now exceeded 100 per cent of GDP in eight Commonwealth countries. A further 24 Commonwealth countries have GGD levels between 60 and 100 per cent of GDP, leaving them increasingly exposed to swings in interest rates, market liquidity and any decline in economic growth prospects.

This growing debt burden limits how much governments can invest in social protection, infrastructure and development priorities – investments that directly impact the daily lives and well-being of their people.

Without strong financial buffers, any external shocks or derailment from orderly public finances could threaten the broader economic and financial stability of many countries with high levels of debt.

Restructuring but pressures remain

Three Commonwealth countries – Ghana, Sri Lanka and Zambia – have undergone debt restructuring in recent years. Sri Lanka and Ghana have reached agreements with diverse creditor groups, including private bondholders through a serious debt restructuring process. To conclude their debt restructuring process, both need to finalise a few remaining creditor agreements. Zambia is undergoing a complex debt restructuring process, having reached a deal with official creditors but still working to finalise terms with private creditors.

A few other Commonwealth countries are finding it difficult to meet payments on maturing local-currency debt and facing liquidity pressures in rolling over foreign-currency debt as financial market conditions tighten.

The challenge for policymakers is clear. Countries need to move towards fiscal consolidation, narrowing deficits and reducing debt, while still delivering essential services. That balance is difficult but essential.

Snapshot of the numbers

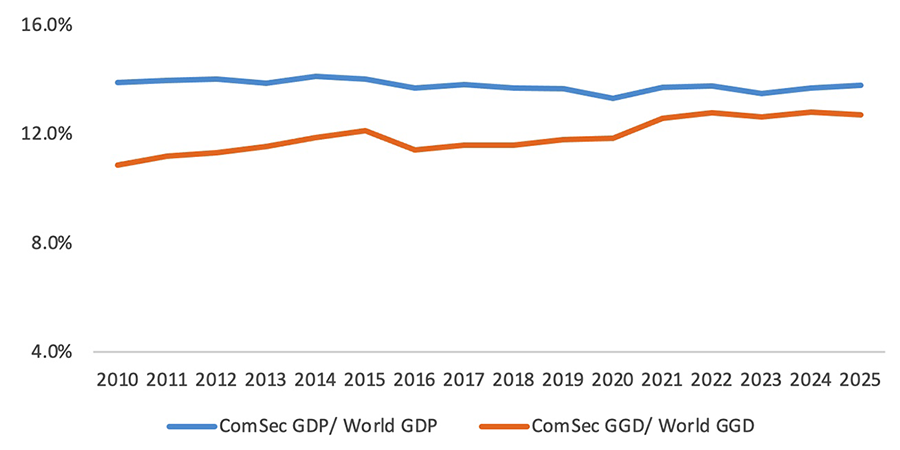

The Commonwealth, representing 56 countries, accounted for 13.3 to 13.8 per cent of global GDP from 2020 to 2025. During this period, their combined GGD made up 11.8 to 12.8 per cent of the world’s total.

While the Commonwealth’s share of the global economy has shrunk since 2020, its overall GGD has increased.

As shown in Figure 1 and Table 1, this trend became more evident after the COVID-19 pandemic, especially in 2023 and 2024. The imbalance - the narrowing gap between what countries produce and what they owe - is making debt vulnerabilities more pronounced. While 2025 projections suggest a modest rebound, many emerging Commonwealth countries remain exposed to global risks, including trade wars and uneven recovery in global demand.

Figure 1: Commonwealth’s Share of GDP and GGD in Global Aggregates

Table 1: Global and Commonwealth GDP and GGD Aggregates

| Year | Global GDP, Global GGD (USD trillion) | ComSec GDP, ComSec GGD (USD trillion) | ComSec GDP & GGD, as a share of Global (%) |

| 2020 | 85.8, 84.8 | 11.4, 10.0 | 13.3%, 11.8% |

| 2022 | 101.9, 91.9 | 14.3, 12.2 | 13.8%, 12.8% |

| 2024 | 110.5, 102.1 | 15.1, 13.1 | 13.7%, 12.8% |

| 2025(F) | 113.8, 108.2 | 15.7, 13.7 | 13.8%, 12.7% |

(F) Forecast

Policy implications

The July 2025 World Economic Outlook (WEO) update projects global economic growth of 3.0 per cent in 2025 and 3.1 per cent in 2026. This reflects a slight improvement from April’s forecast, driven by stronger-than-expected front-loading of trade frictions and lower average effective US tariff rates than initially announced.

This moderate improvement in global growth is good news for debt, because faster growth makes countries’ debt burdens easier to manage. For many Commonwealth countries, especially emerging markets, this could provide a welcome boost. Their position in global value chains and exposure to trade flows means improved global growth can reduce some debt pressures through higher revenues and investment flows.

Importantly, global financial conditions have eased in recent months compared to equity market routes and the steepening yield curve noticed in the first quarter and in April 2025. For debtor countries, the recent depreciation of the US dollar has provided short term relief in debt servicing.

Meanwhile, the passage of the One Big Beautiful Bill Act has clarified the near-term trajectory of US fiscal policy but added uncertainty over longer-term fiscal sustainability. The term premium on longer-term US Treasuries has spiked. As a result, despite the short-term relief from a weaker US dollar, many emerging and developing Commonwealth countries remain exposed to higher absolute interest rates for market-based finances and benchmarked loans and financial obligations.

Action is needed

To overcome growing GGD vulnerabilities, particularly in low-income Commonwealth countries, it is important to address revenue gaps and find new income sources. This requires a return to fiscal consolidation policies to reduce deficits and overall debt levels.

For countries already carrying high public debt and facing challenges in financial markets, a comprehensive approach is needed. This includes fiscal discipline, debt reprofiling, and, where required, debt restructuring.

A few Commonwealth countries have already started tackling their debt challenges by working with a wide range of creditors on comprehensive debt consolidation, reprofiling and restructuring plans. By negotiating in good faith with both domestic and international lenders and agreeing on solutions that meet international debt sustainability standards and ensure fair treatment among all creditors, and some have been able to successfully consolidate and restructure parts of their debt.

However, challenges remain. Many countries struggle to complete debt reprofiling and restructuring quickly, or to take early steps to stabilise public debt. Opportunities such as swapping or buying back debt or reducing the more volatile parts of their debt portfolios, are often not fully used.

Acting on rising debt-to-GDP ratios is now crucial, except in cases where countries are building sovereign assets. Creating fiscal space where possible and streamlining public finances into transparent, well-managed debt practices will strengthen resilience.

Commonwealth Secretariat support

Throughout this process, the Commonwealth Secretariat is working closely with member countries on strategies to upscale their debt management policies and practices. Our support ranges from bespoke advisory services to the state-of-the-art Commonwealth Meridian debt management software, helping them manage their debt portfolios sustainably and transparently. We are accelerating our ongoing support, particularly this year, which has been declared by leaders as the Commonwealth Year of Resilient, Innovative and Sustainable Debt.

We know the window to act is narrowing. Commonwealth countries that strengthen public finances now, use every tool to manage debt proactively, and build resilience against future shocks will be far better placed to sustain growth and protect their people.

Delay will only make the eventual adjustment more painful.