Blog by Travis Mitchell, Adviser and Head, Economic Policy and Small States

On 17 June, 2022 flanked by Prime Minister of Barbados Hon. Mia Amor Mottley and Canadian Deputy Prime Minister Chrystia Freeland, IMF Managing Director Kristalina Georgieva announced that the IMF Board had approved its most innovative instrument yet, the Resilience Sustainability Trust (RST).*

Filled with excitement, the Managing Director further explained that the RST was the first IMF instrument to include vulnerability as a criterion for access to concessional financing, meaning that unlike other concessional windows, the RST will not exclude small states.

Additionally, the instrument will carry a 10.5 year grace period and a maturity profile of 20 years, making it the longest duration financing mechanism in the IMF toolkit.

At the Commonwealth Ministerial Meeting on Small States (CMMSS) being held this Wednesday 22 June in Rwanda, Small States’ Foreign Ministers and indeed Canada and others who have made initial contributions to the instrument, will celebrate its introduction and probably claim a paradigm shift in development financing.

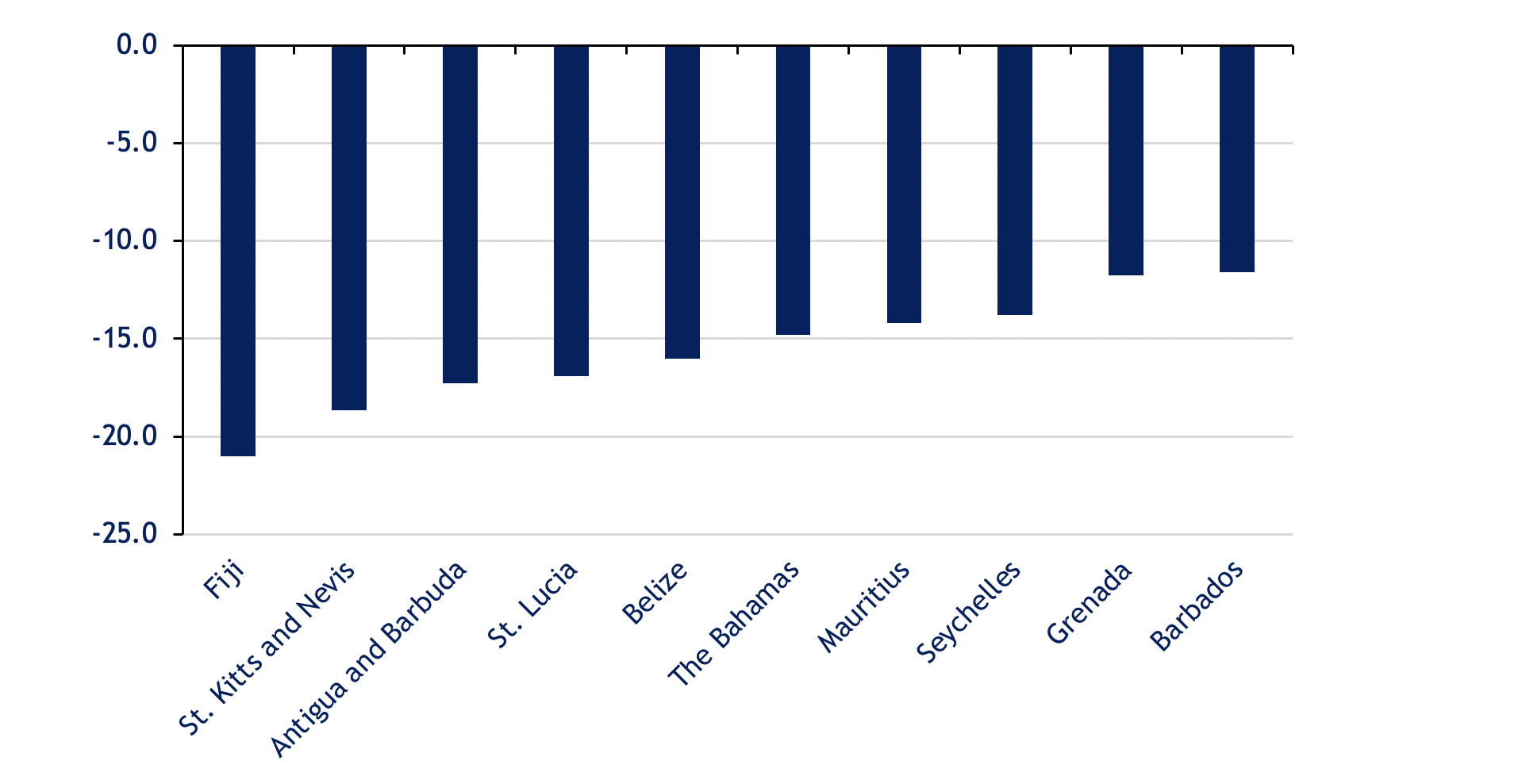

After all, small states have been devastated by the COVID19 pandemic and are in dire need of recovery capital (Figure 1).

Figure 1: Commonwealth countries with the highest GDP contraction in 2020 (Annual %)

To a large extent, the IMF move does represent a paradigm shift. For over 30 years the Commonwealth Secretariat has been advocating for change to the International Financial Institutions (IFIs) and Development Banks’ financing frameworks to recognise vulnerability.

It has taken some persistence and influential voices to get us this far. However, there are some that will also argue that the move still doesn’t go far enough. There are indeed issues relating to the RST’s financing scale given small states’ infrastructural challenges, and even with its maturity profile.

The Commonwealth Secretariat in its presentation to Foreign Ministers on Wednesday will raise an important issue – the RST is a one-off instrument. Further, the Secretariat will emphasise that the RST is not the answer to small states’ historical calls for a change in the IFI financing architecture.

In our second report following the introduction of the Commonwealth Universal Vulnerability Index (UVI), we argue that the current Gross National Income (GNI) per capita criterion used to determine eligibility to the World Bank’s International Development Association (IDA) and Blend resources, and by extension, the resources of many Bilateral lenders and Development Banks, could be adapted to take account of vulnerability by fusing it with the Secretariat’s UVI measure.

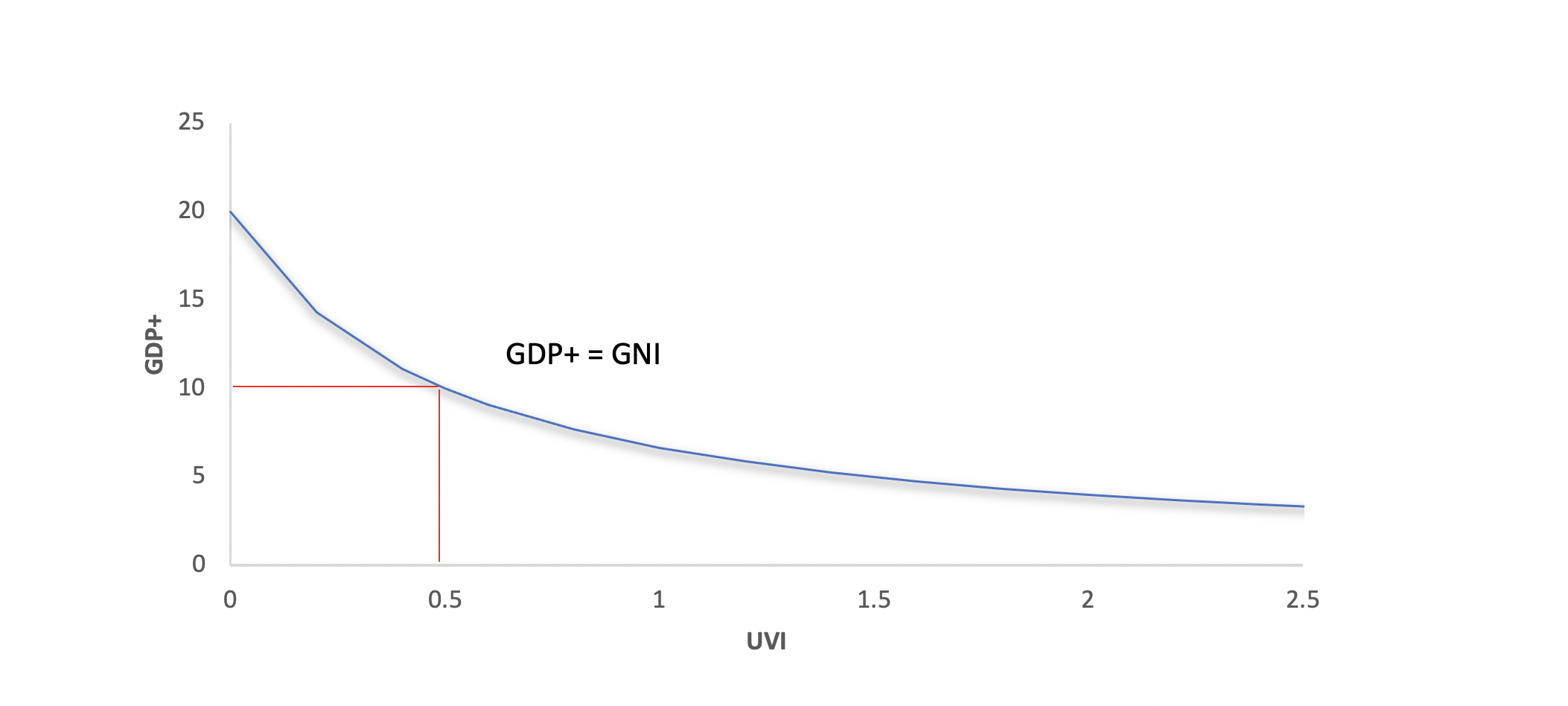

In the report, we assert that this would create a new measure – GDP+ – which would more adequately reflect countries’ financing needs. With the GDP+ criterion, UVI scores above 0.5 (vulnerability) result in a downwardly adjusted GNI per capita, and vice versa for UVI scores below 0.5 (resilience) (See Figure 2).

Figure 2: GDP+, A Graphical presentation

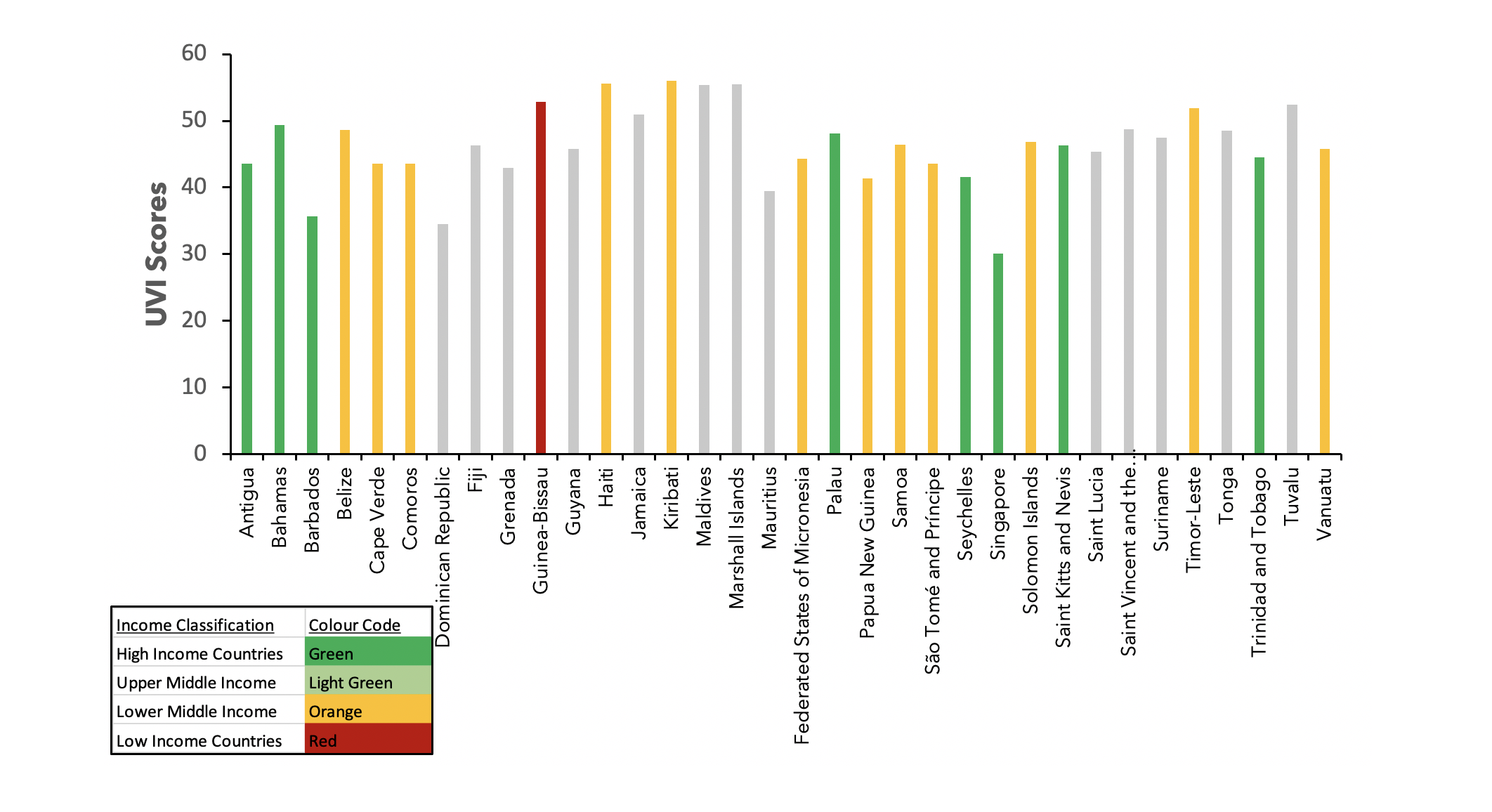

As it stands, the World Bank’s GNI per capita criterion implies that a country’s resilience or ability to respond to shocks is solely determined by its income capacity. We know this not to be true, and such is evidenced in the Secretariat’s second report by showing that although they are several countries characterised as high and middle-income, it is clear several of these countries still face quite significant vulnerabilities (Figure 3).

Figure 3: The Commonwealth UVI Scores for SIDS

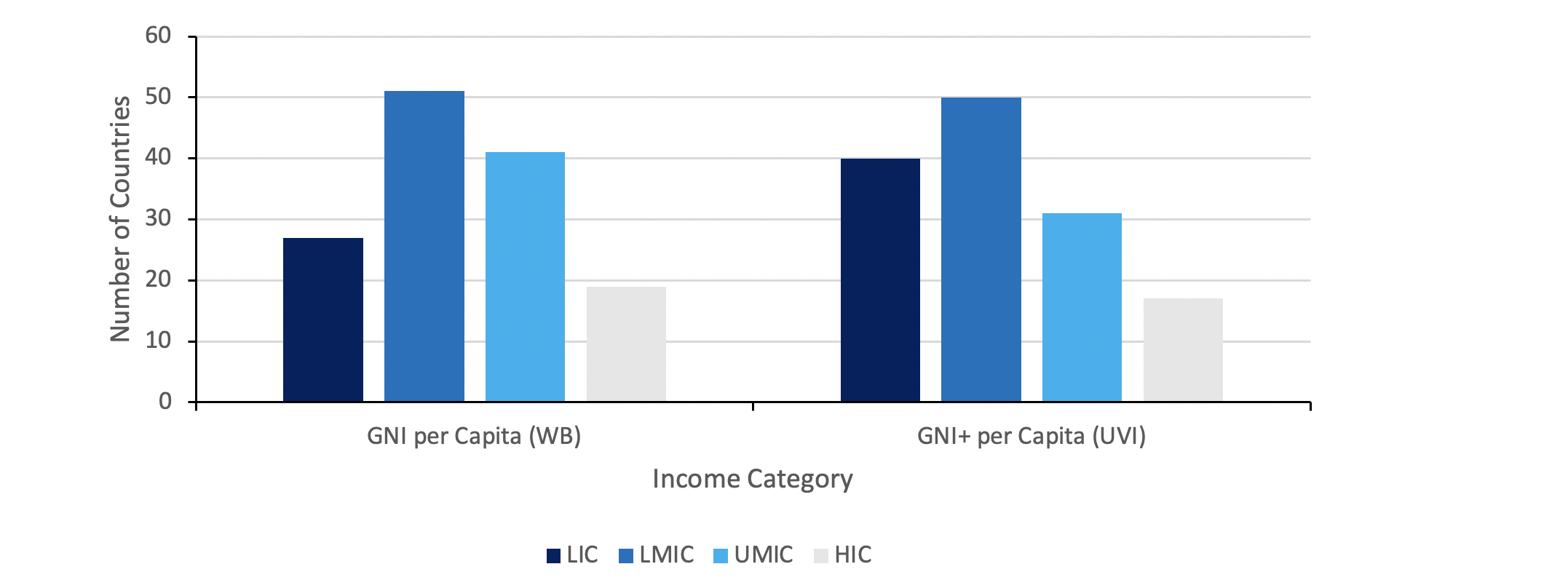

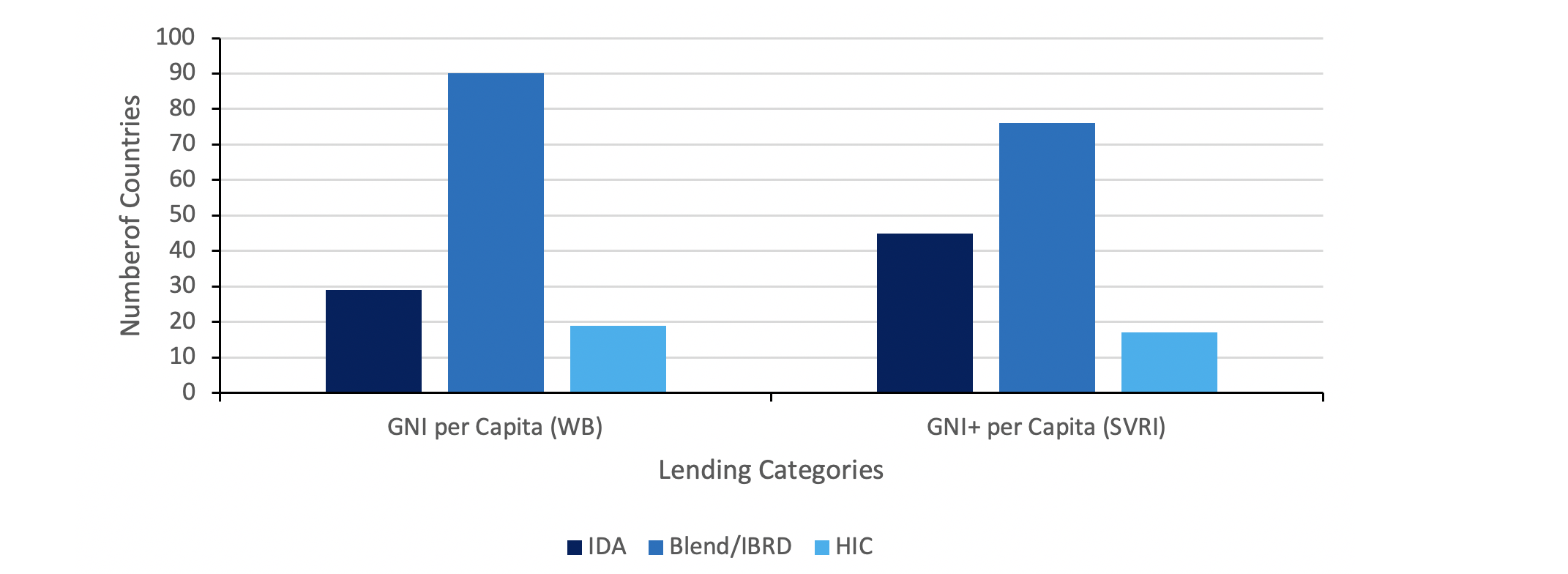

Driven by this argument, we apply the GDP+ criterion and conclude that a number of small states previously deemed ineligible for concessional resources would now fall into the eligibility category if the new measure were applied, while those small states at high-income levels even if not falling into current eligibility categories would be re-characterised as middle to lower-middle-income depending on their current challenges and vulnerabilities (Figures 4-5).

Figure 4: Effect of using the GDP+ income measure on World Bank country classifications

Figure 5: Effect of using the GDP+ income measure on IFI lending group eligibility

These results are possibly similar to that of the IMF RST eligibility assessment, given that over 143 countries are deemed eligible for that instrument.

However, we are proposing a criterion that could be more widely applied, and that would see a larger scale of financing made available. It will be interesting to hear the views of Commonwealth Foreign Ministers.

In reality, GDP+ or any proposal of this nature will ultimately depend on the success of the RST as the IMF and other IFIs assess the feasibility of introducing vulnerability measures in the eligibility criteria for concessional financing.

*The RST has so far attracted US$45 billion or 33 billion IMF Special Drawing Rights (SDRs), which are the stock of funds contributed by member governments that the IMF lends out to help countries in balance of payments’ crises. Over 143 IMF member countries are eligible for the RST, but RST financing is capped at 150 percent of quota, where quota refers to countries’ required IMF contributions.

Media contact

- Rena Gashumba Communications Adviser, Communications Division, Commonwealth Secretariat

- T: +44 7483 919 968 | E-mail