This blog is authored by three experts from the Commonwealth Secretariat: Dr. Thomas Munthali (Adviser and Head, Economic Policy and Small States Economic Development, Trade and Investment Directorate), Tamara Mughogho (Economic Adviser, Economic Policy and Small States, Trade and Investment Directorate), and Dr. Ruth Kattumuri (Senior Director, Economic, Development, Trade and Investment Directorate).

For decades, small states have watched their best and brightest leave. But what if emigration was not an end, but rather the beginning of unprecedented investment opportunities?

This blog draws on findings from the Commonwealth’s July 2025 paper, From Brain Drain to Brain Gain: Unlocking Diaspora Finance in Small States, which explores how diaspora finance can be a transformative force for small states.

Small states are not just small in size, they are often boxed in by shrinking aid, rising debt, and a barrage of external shocks, from climate crises to pandemics. But beyond the usual suspects in development financing, there is a sleeping giant with the potential to reshape futures: diaspora finance. This includes both remittances and diaspora investment, which, if properly leveraged can help support these economies.

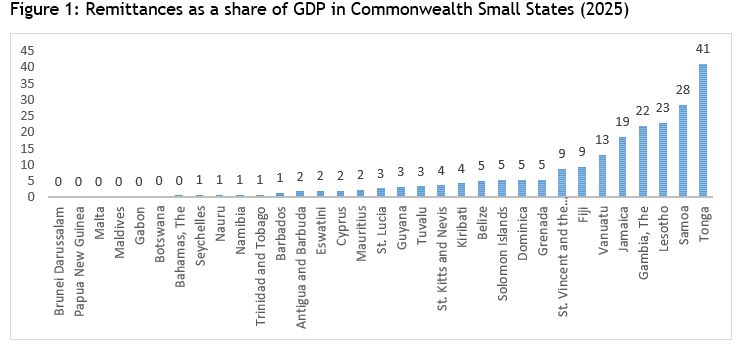

For many small states, remittances already play a crucial role, contributing significantly to their Gross Domestic Product, ranging from around 2% in Antigua and Barbados to as high as 41% in Tonga (see Figure 1). Such diaspora contributions are far greater than what key sectors like mining contribute to developing countries like Malawi.

Figure 1: Remittances as a share of GDP in Commonwealth Small States (2025)

Source: World Development Indicators

The diaspora of developing countries holds more than sentiment, it holds savings and serious capital. According to our research, Commonwealth member countries alone have an estimated diaspora investment potential of $73.2 billion. To unlock this, member states must embrace a wider range of financial instruments, from basic savings accounts to cutting-edge diaspora bonds.

Diasporas can power start-ups, fuel venture capital, and invest in specialised financial products tailored to national development priorities. The key? Smart tools, strategic engagement, and a business environment they trust.

The emotional engine of development

Diaspora finance is not just remittances, it is investment capital, bonds, crowdfunding, and goodwill. And unlike foreign direct investment or aid, this money has a secret ingredient: emotion.

Citizens living abroad often invest in their homeland not for maximum profit, but out of patriotism. Economists call this the “patriotic discount”, where lower returns are accepted because the mission matters more than the margin. This deep emotional tether makes diaspora finance one of the most resilient and loyal sources of capital small states can tap.

Countries like Pakistan and Tonga are rewriting the narrative. Pakistan’s Remittances Initiative not only made transfers cheaper but turned overseas citizens into investors. Tonga’s Ave Pa Anga Pau digital platform has revolutionised remittance flow, cutting costs and boosting local development. The result? Remittances now power over 40% of Tonga’s GDP. The diaspora is not just sending money; it is driving the momentum for local investments.

Climate action with community capital

Small states contribute almost nothing to climate change but suffer the most from its impacts. Yet climate finance remains elusive. That is where diaspora communities step in, not waiting for global funds, but backing grassroots solutions.

Across the world, diasporas are funding solar farms in Nigeria, rebuilding flood-stricken communities in Pakistan, and buying into green bonds that promise environmental and economic returns. Remittances are no longer just survival; they are strategic.

With climate-focused diaspora funds, small states can build renewable energy infrastructure, support green jobs, and unlock climate insurance, powered by people who care the most: citizens in the diaspora.

Tourism, reimagined by returnees

Tourism is both a lifeline and a liability for many Commonwealth small states, it drives economies but wilts under global shocks. Diaspora investors offer a chance to rebuild it smarter.

According to the Jamaica Gleaner, Jamaica saw $86 million pledged by diaspora backers to build a luxury resort. Dominica’s Jungle Bay Resort, created by a returning citizen, is now a regional model for eco-tourism. Airbnb-style investments by diasporas are also injecting freshness into travel, while returnees act as unofficial ambassadors, reshaping tourism narratives.

Spotlight on diaspora bonds

Diaspora bonds, first pioneered by Israel in 1951, are government-backed debt instruments designed to tap into the diaspora’s patriotic investment instinct. India’s three successful bond issuances and Nigeria’s oversubscribed 2017 offering by over 130% showcase what is possible when patriotism meets policy. Ghana’s 2007 Golden Jubilee bond, however, fell short of expectations, and Kenya saw only modest success.

Lessons? Trust, transparency, and marketing matter. The product must align with the emotional and financial needs of the diaspora; otherwise, even patriotism will not close the deal.

Big opportunities for small states

To fully unlock diaspora finance, small states need more than vision, they need strategy.

Here’s what that looks like:

- Design diaspora-friendly tools: Real estate remains popular, hence it’s worth offering mortgage schemes or targeted development projects.

- Facilitate remittances: Lower costs, improve access, and digitise transfers.

- Boost the business climate: Incentives, tax relief, special economic zone infrastructure, and risk protection can tip the scales.

- Protect rights and consumers: Citizenship, voting rights, and transparency build trust.

- Promote, promote, promote: Diaspora platforms, embassies, and continuous engagement are key.

- Lean into tech: Fintech, blockchain, and digital platforms open new doors.

Trust is the currency of diaspora investment. Without it, even the most promising products go untouched.

What’s next?

Diaspora finance is not a silver bullet. It is a spark. It is capital with a heart, strategy with a soul. For small states searching for resilience in a turbulent world, the answer might not lie in foreign boardrooms of multilateral finance institutions but in the inboxes and intentions of citizens abroad.

It is time to stop seeing the diaspora as distant and simply brain drain. They are development partners waiting to be invited in.