Since the last financial crisis of 2008-09, investments in technology-enabled financial services (‘FinTech’) have been growing. Yet the COVID-19 pandemic has created and amplified a second wave of FinTech advancements, leading to increased financial innovation.

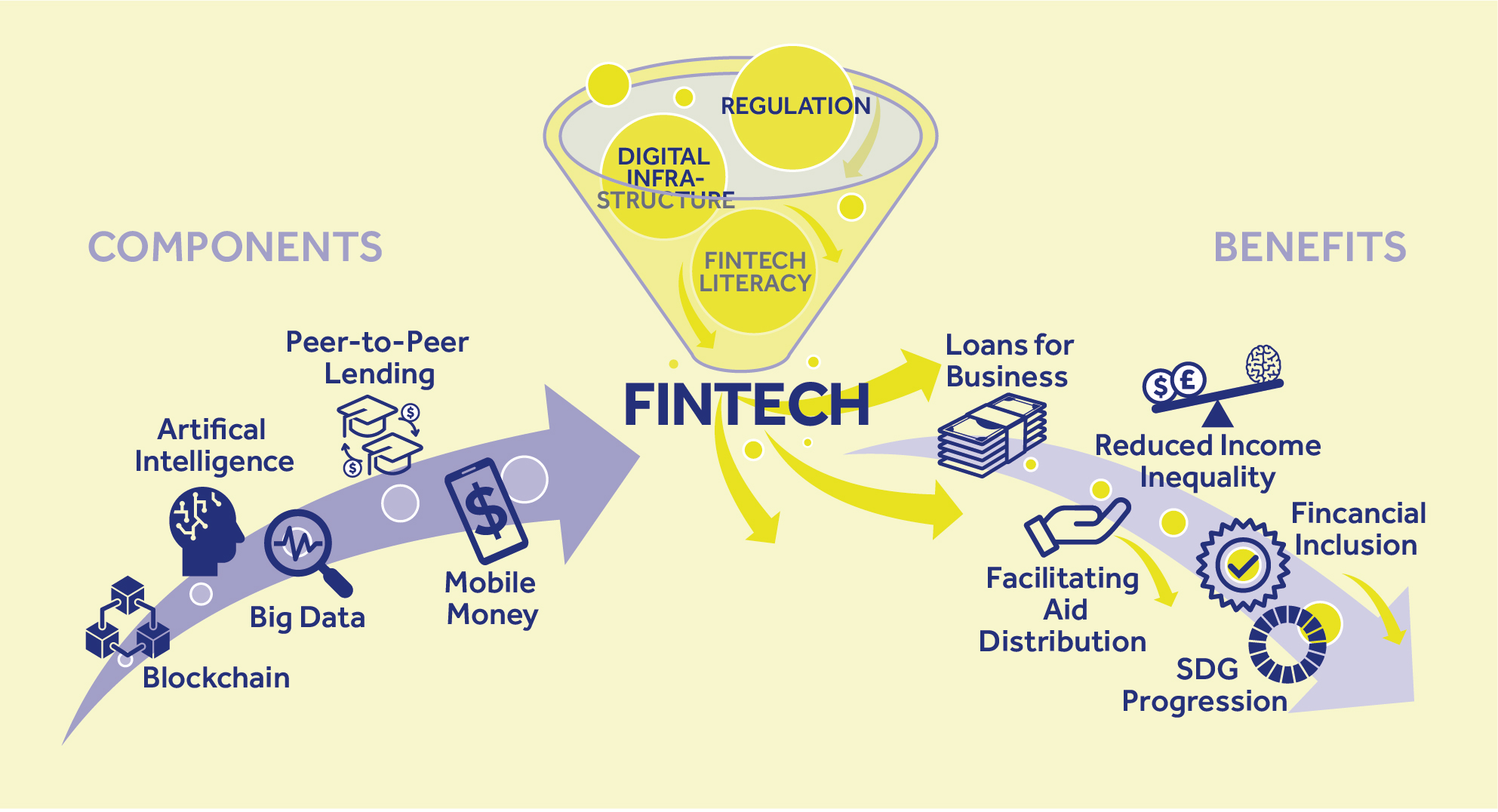

Emerging technologies, such as artificial intelligence, big data, blockchain, digital identity and digital financial services are changing the financial landscape as we know it.

The COVID-19 pandemic has not only accelerated the shift toward digital and Contactless payments, but has also led to a more mainstream acceptance of physical cash alternatives.

Several Commonwealth member countries, such as Kenya, Nigeria, The Bahamas and the countries of the Eastern Caribbean Currency Union are at the forefront of the evolutionary advances in FinTech.

This report brings together key pieces of information from leaders across the FinTech landscape, including FinTech technologies, drivers of FinTech that can be harnessed, case studies, and recommendations and regulatory best practices that will promote the growth of FinTech innovation.

Economic development

The aim of this report is to provide an evidence-based approach to financial innovations and their impact on the attainment of the Sustainable Development Goals and other areas of development.

The report finds that FinTech leads to economic growth and improved economic performance, with increased contributions from the financial sector and e-commerce turnover.

FinTech innovations, such as mobile money, have been found to reduce poverty and income inequality and reduce the rural-urban income gap, while increasing financial inclusion. In some cases, FinTech has also been shown to act as an enabler for entrepreneurship among rural residents.

FinTech has been proven to help the most marginalised in society – including women and young people – by tackling financial exclusion challenges, resulting in an increase in financial inclusion rates.

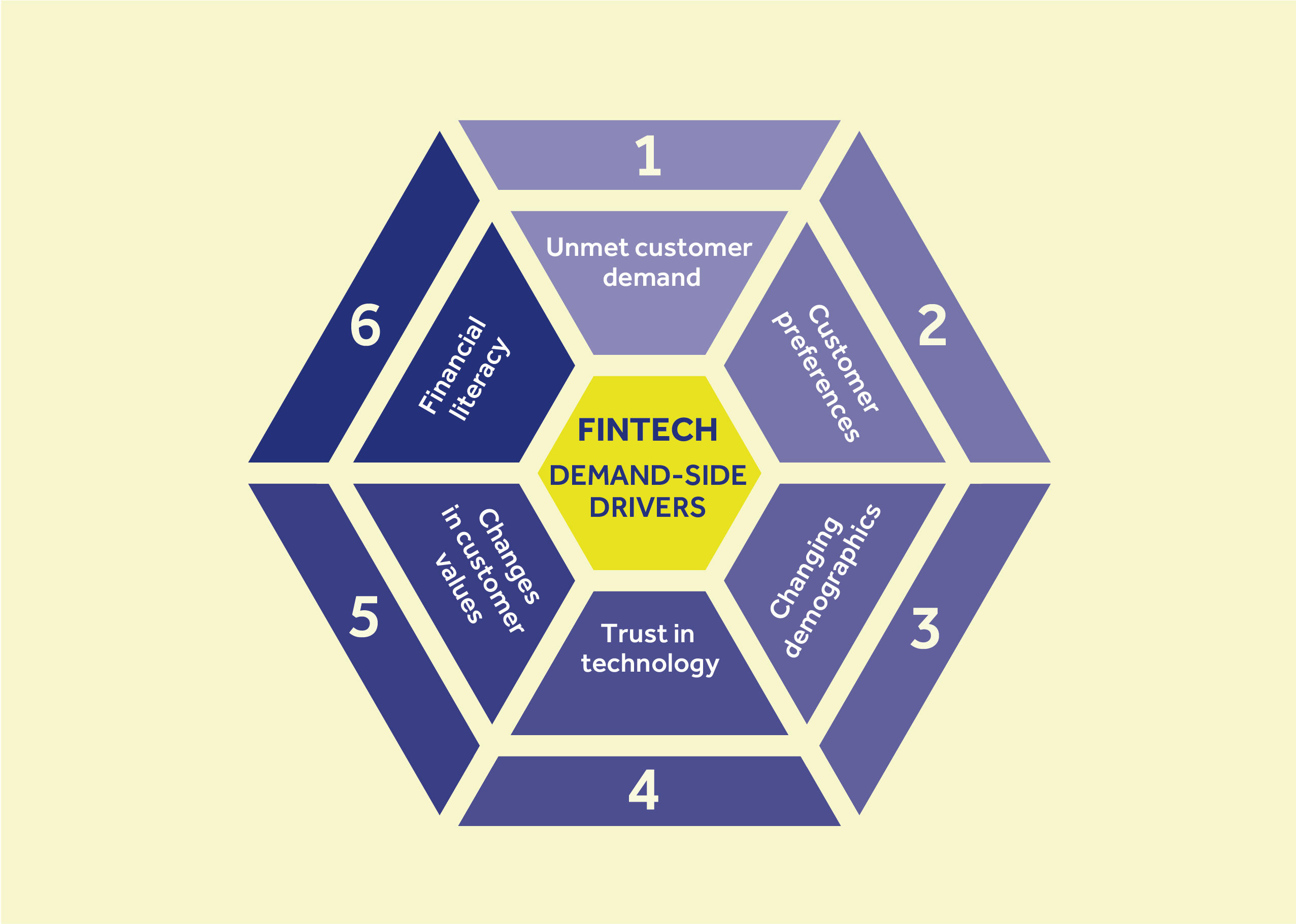

Research shows that financial literacy can help improve financial inclusion and contribute to economic growth, financial stability, and sustainable development.

FinTech across the Commonwealth

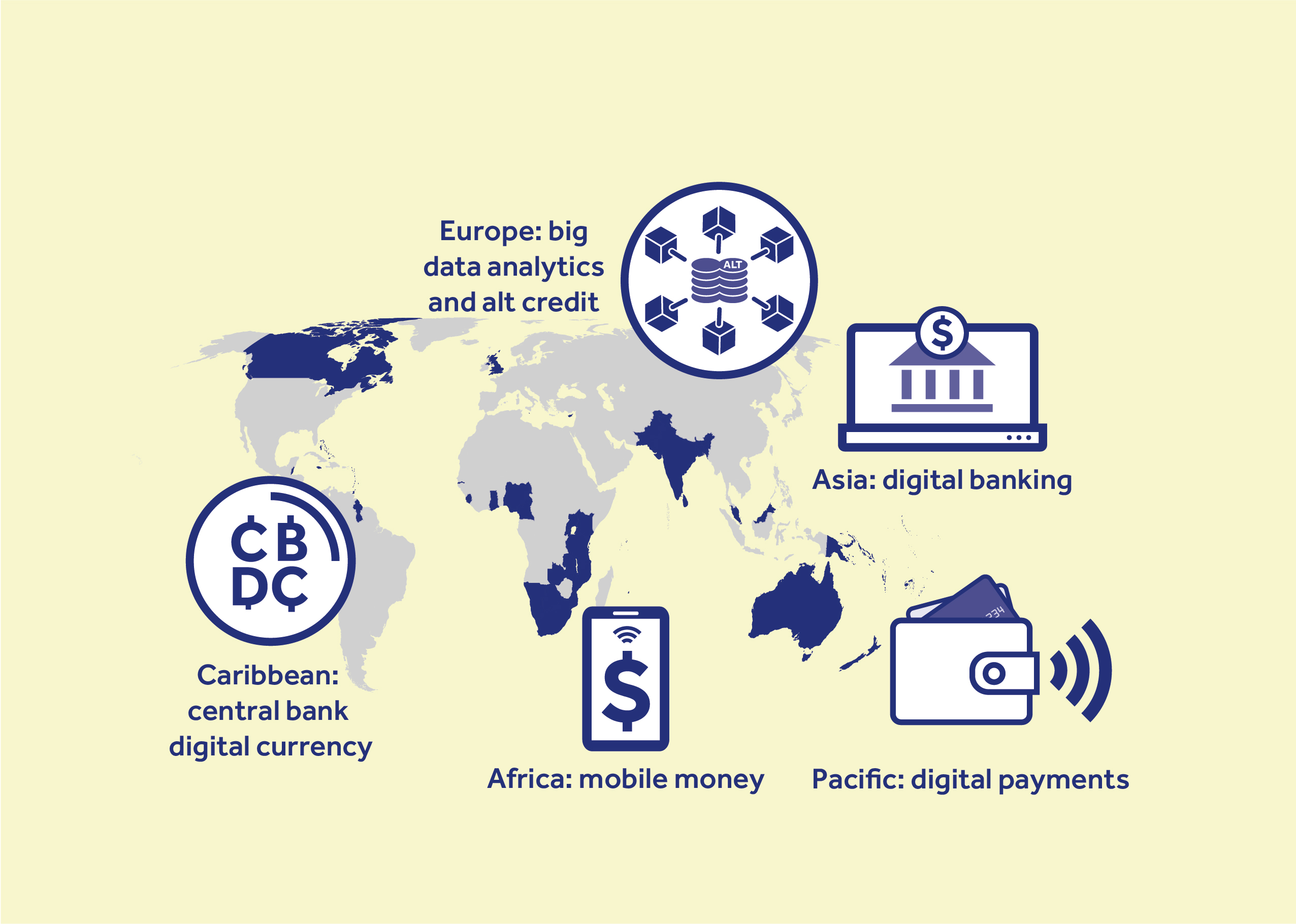

The growth and use of FinTech is not homogenous across member countries.

FinTech applications, such as mobile money, that are popular in East Africa are different from those, such as central bank digital currencies that are more common in the Caribbean.

Financial policies and regulatory innovations in Europe are different from those in Asia, while the development challenges in the Pacific are different from those of other member countries.

There cannot be a ‘one size fits all’ approach to regulating FinTech. Countries will want to contextualise their objectives, challenges, and environment to build upon an evolving framework to shape an optimal approach.

Opportunity to lead

The evidence from this report suggests that opportunities are ripe for learning from Commonwealth FinTech pioneers, to support FinTech capacity building across the Commonwealth as well as prospects for partnering and knowledge sharing with other Commonwealth countries.

It also provides an opportunity for the Commonwealth Secretariat to be an enabler and supporter of FinTech as the FinTech wave continues.

Now is an opportune time for Commonwealth countries to create an enabling environment for FinTech, so that they can reap the benefits from the technology and its innovative services.