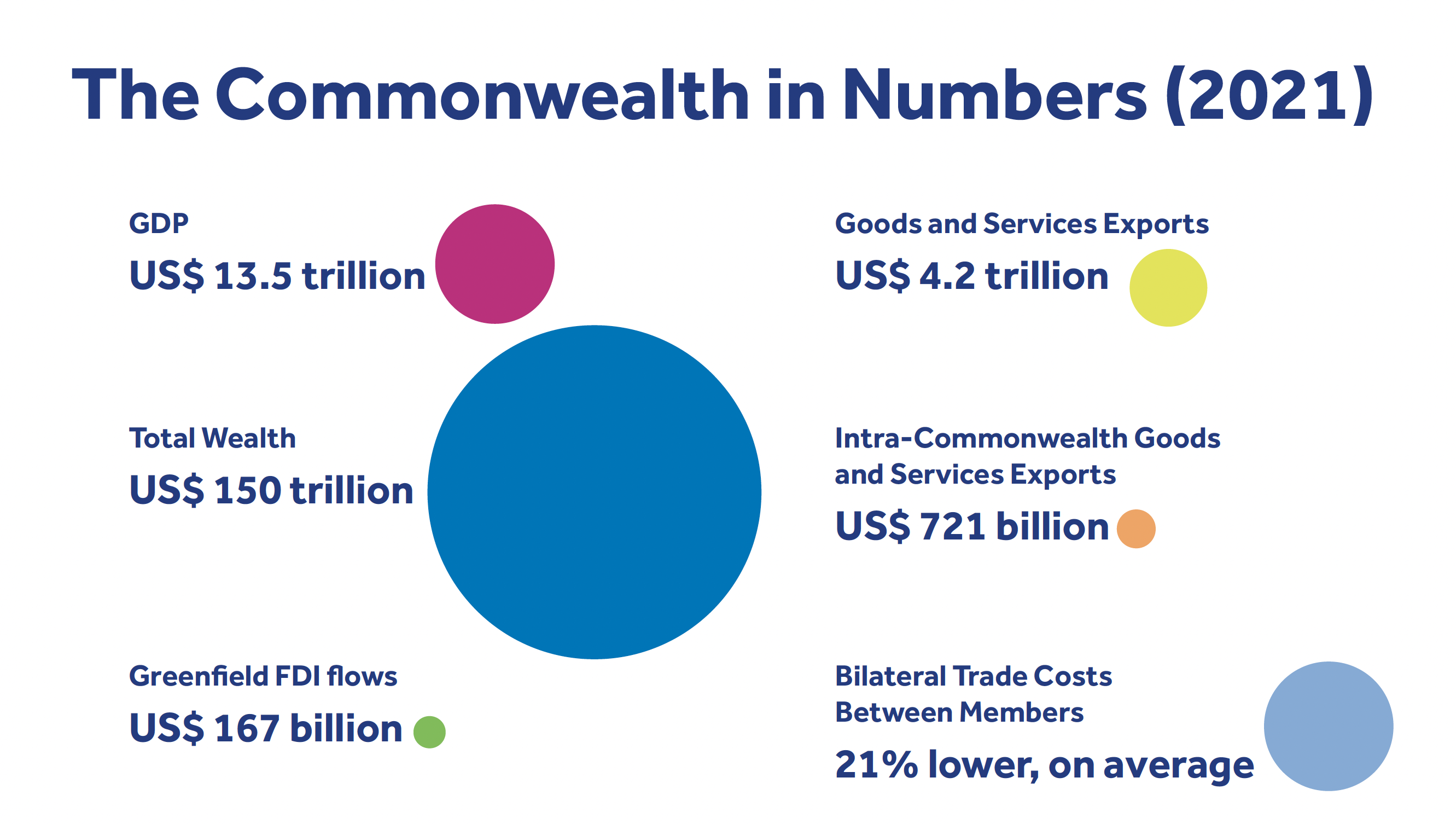

Together, the 56 Commonwealth countries possess approximately US$150 trillion of wealth. This is 10 times greater than the value of their combined GDP (US$14.5 trillion) and 30 times more significant than the value of their global exports of goods and services ($4.8 trillion).

Blog by Salamat Ali, Economic Adviser, and Brendan Vickers, Head of International Trade Policy Section, Commonwealth Secretariat

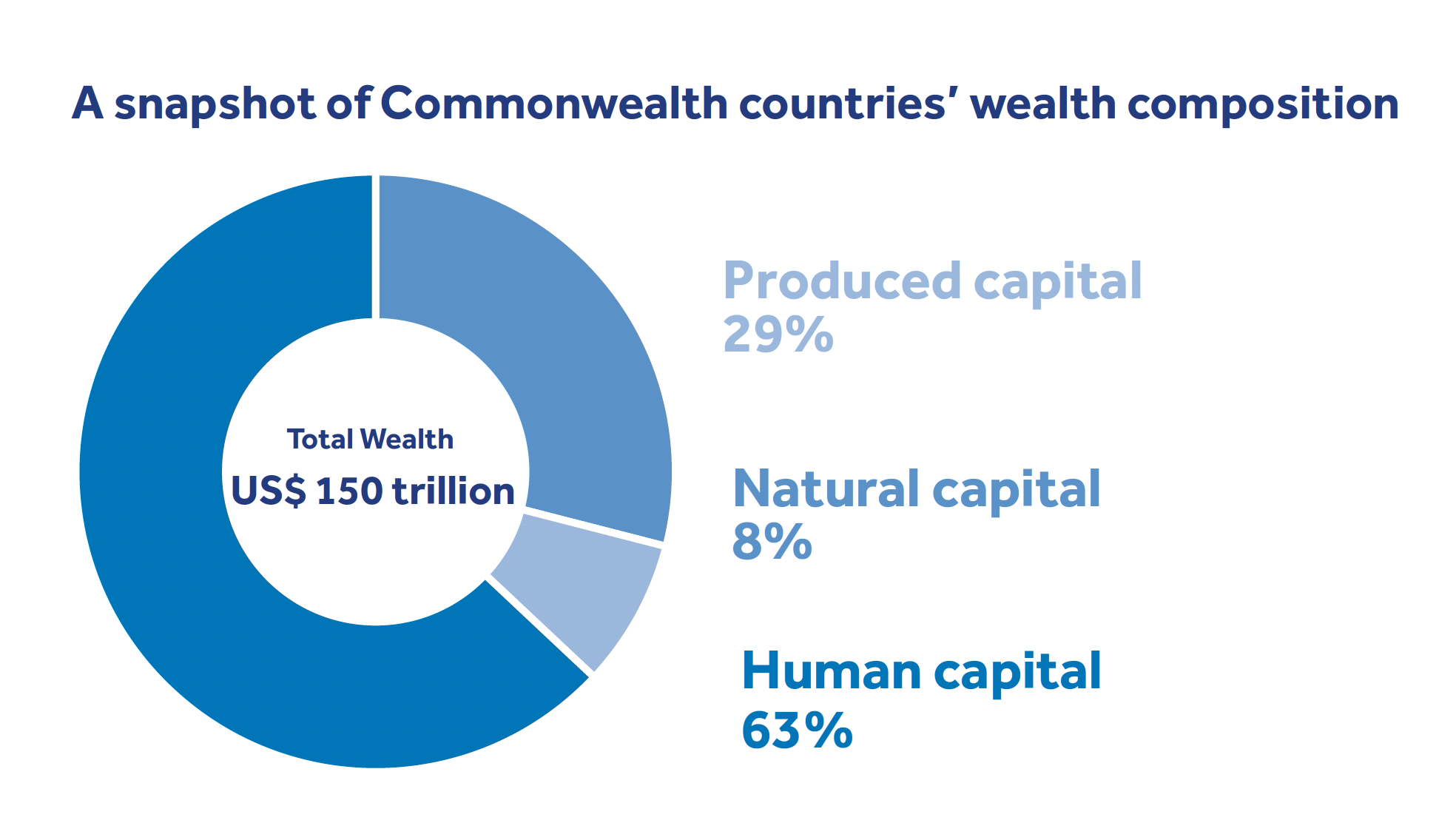

Three key components of this multidimensional measure of the wealth are physical capital (such as infrastructure and buildings), human capital (such as education and skills of the workforce), natural resources (both renewables and non-renewables).

- Human capital, valued at US$96 trillion, is the largest asset of Commonwealth countries, accounting for almost two-thirds of their total wealth. It is measured in terms of the present value of future earnings that can be expected from the working population over their lifetimes. Human capital considers factors, such as education, knowledge and skills, work experience, health and the likelihood of labour force participation.

- Produced capital is the second largest class of assets held by Commonwealth countries, valued at US$45 trillion. It measures the value of machinery and equipment, buildings and infrastructure, and residential and non-residential urban land. Produced capital represents about 29 percent of the total wealth of Commonwealth countries.

- Natural capital stock of Commonwealth countries is valued at US$12 trillion. It encompasses both non-renewable assets (including fossil fuels such as oil, gas, and coal; and minerals such as bauxite, copper, gold, iron ore, lead, nickel, phosphate, silver, tin and zinc), as well as renewable assets (such as agricultural land and forests, blue natural capital, protected areas and renewable energy resources).

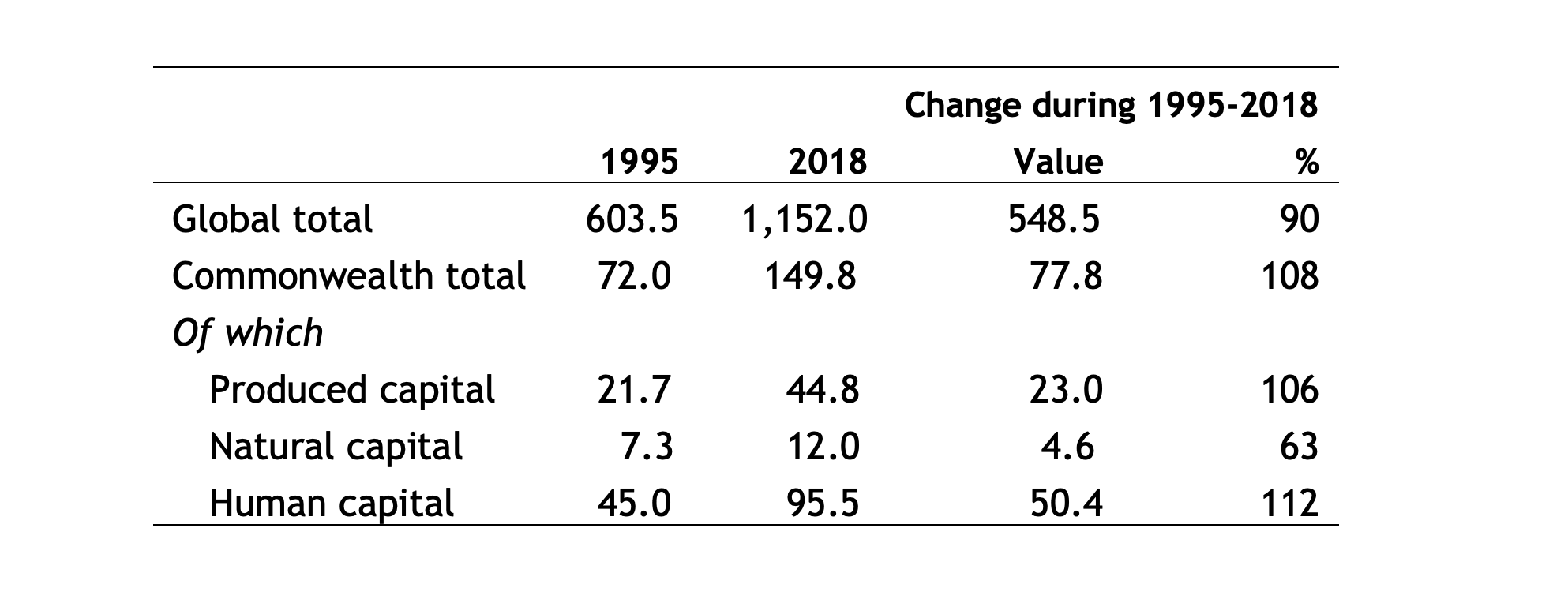

Commonwealth countries’ wealth has grown by more than 108 percent between 1995 and 2018, surpassing the growth in global wealth (90 percent) in the same period. It has raised per capita wealth in the Commonwealth from US$42,700 to $59,800 despite the rapid rise in population from 1.7 billion to 2.5 billion. The primary driver of this increase has been the expansion of human resources and produced capital stocks, which saw an extraordinary increase, particularly in Asia and Africa (Table 1).

Table 1: Growth in Commonwealth countries’ wealth over time (US$ trillion and share)

Implications of the stock of assets for trade and investment prospects

This comprehensive stock of wealth highlights Commonwealth countries’ productive potential, trade and investment prospects, as well as their ability to develop resilience in the face of shocks. In this era of multiple and interconnected crises, marked by the aftershocks of the COVID-19 pandemic, food insecurity, climate change threats and rising inflation, a country’s ability to respond effectively to multiple shocks and maintain resilience hinges on the effective management of these three classes of assets.

Human capital is the most important form of assets in the digital and information age. The Commonwealth has 1.5 billion young persons that not only represent a substantial consumer market but also provide a big pool of tech-savvy workers, essential to boost production and drive trade, particularly in the services sector. Harnessing this talent pool can provide another development pathway through the services-led structural transformation.

The natural resources wealth, both renewable and non-renewable, is important as countries grow and develop, and accelerate transition to greener and more circular economies. These assets are equally important to successfully face climate shocks: for example, mangroves that can help protect against coastal flooding and forests can act as natural carbon sinks.

While Commonwealth countries have a larger share of natural capital compared with the rest of the world, they do lag slightly in terms of produced capital, indicating large infrastructure development needs in emerging countries. However, the produced capital stock of developing countries is expanding rapidly, doubling in value terms from 1995 to 2018. This reflects, in part, the large focus on hard infrastructure development and, in part, the rapid pace of urbanisation in these economies.

Transforming in-situ wealth to actual wealth and income

Three policy pathways can help to translate this comprehensive wealth account into meaningful outcomes such as economic growth, poverty reduction and structural transformation:

The most significant wealth of Commonwealth countries lies in their human resources. By investing in education, skills development, entrepreneurship and technology, these countries can harness the potential of their human capital to drive economic growth, increase productivity and expand trade, especially in the services sector. This services-led structural transformation can create employment opportunities and enhance competitiveness.

The ongoing restructuring of regional and global value chains offers numerous opportunities for Commonwealth members to leverage their abundant natural wealth to promote sustainable production and trade. Commonwealth countries possess abundant natural resources and renewable assets. With the growing focus on environmental concerns, Commonwealth countries are well-positioned to provide a wide range of environmental goods and services.

Commonwealth countries also hold a substantial stock of critical minerals required for the clean energy transition and digitalisation. This creates numerous opportunities to attract investment in emerging sectors, such as climate adaptation and digital technologies. Countries can facilitate investment in these emerging sectors by streamlining their regulatory environment.

Media contact

- Rena Gashumba Communications Adviser, Communications Division, Commonwealth Secretariat

- T: +44 7483 919 968 | E-mail